Planning your finances is the first step towards achieving financial freedom. If you fail to plan, your family may not enjoy financial security in the future. Organizing your finances goes beyond earning a salary and settling bills. It would be best to save, invest, and adopt the right strategies to achieve financial stability. Here are steps you can take to obtain financial security.

Evaluate Your Current Financial Position

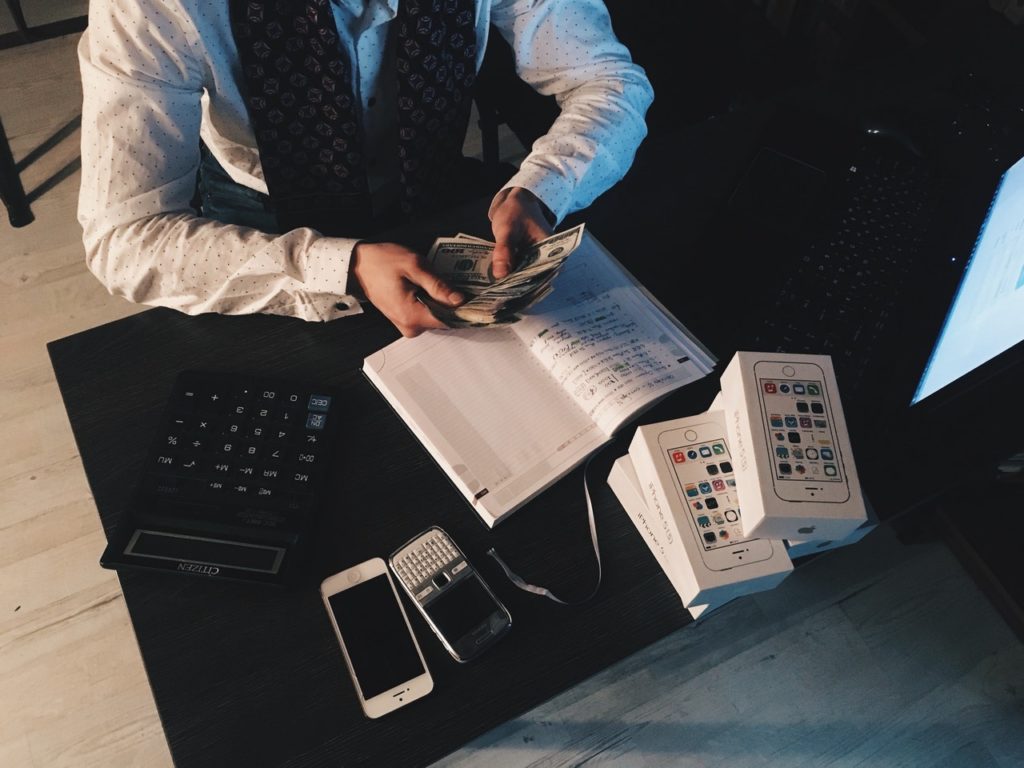

You cannot address the future of your finances if you don’t know your current standing. Sit down and evaluate your position financially; analyze your savings, investments, loans, and how you are settling them. You can download an app or use a book to record your cash flow. It would help you take measures to suppress impulse buying.

It would be best if you also built a good credit score. You have to be in good standing with your creditors to have a stable financial future. An adverse credit score can slowly paralyze your financial goals. Therefore, make it a habit to service your loans on time. Also, ensure you settle bills in good time to improve your credit rating.

Create a Budget and Stick to It

A budget is an essential financial tool. If you can allocate your money in the right way, you will certainly achieve your goals. Remember that the ultimate goal of having a budget should be to avoid spending more than what you earn.

It would be best if you also kept your spouse updated on your budget and financial status. Both of you will commit in equal measure to ensure that you achieve your goals. As a couple, you can enhance discipline by installing a budgeting program on your phones to guide your spending.

Save and Invest

There are many steps to improve your financial situation, and planning for lifelong financial stability is one of them. This is a critical process that requires you to handle and manage what you have well. Evaluate your pay and develop a good loan repayment plan that will help you to pay debts without struggles. While on it, maintain a saving balance even as you focus on investing.

It is essential to set aside money for a rainy day, but investing is equally important. If you choose to invest in stock markets, do your research to be sure you can sustain your financial safety net. Growing your bank account can be a daunting process. It requires commitment, proper budgeting, and self-discipline.

Ensure You Age in Place

Your youthful years may appear to be many, but they will eventually go. That is why you should manage your finances properly and consider current and future needs. Buying a home before you retire ensures flexibility in your golden years. At that age, you will only have to invest your money in your health and in touching up your retirement home.

But how can you own a home? You don’t necessarily have to buy a home with your savings; you can take a mortgage. All you need is to check out the best mortgage rates and work towards owning your dream home. If you have an income and deposit that qualifies you for the mortgage option, then take up the opportunity and settle the monthly payments as agreed.

Seek Help From Financial Advisors

It is not easy to successfully manage finances. Once you lay out your plan and decide what you want, you could consult a financial planner as a family. They will guide you through making prudent financial decisions. You can even list your investment ideas and present them to your financial advisor for guidance. A reliable financial planner will list the pros and cons of each investment for your evaluation. They could also assist you in finding products that match your preferences.

Living a financially stable and prosperous life in your golden years is quite fulfilling. You are likely to live longer when you are financially stable. The most dangerous thing would be to feel like a burden to your loved ones because you failed when you were young.