For most people, the path to financial security is relatively straightforward. You work and save enough money to buy a house or start a business. You might even have a modest savings account and a retirement fund. But some people want more than what they can get from a regular 9-to-5 job. One way to earn more money is to invest.

You don’t need an MBA or a degree in finance to start investing. However, it also carries a lot of risks. While wealthy people can afford to play with their money, average Joes can lose everything if they make a bad bet. That’s why it’s important to know the basics of investing. If you know what you’re looking for and where to look, you can make better investment decisions.

One important concept in investing is risk and reward. Some people think you need to invest in risky ventures to get a big payoff, but they have it backward. Many risky investments generate low returns or fail outright. But if you want a bigger return, you need to deal with inherent risk.

If you’re like most people, you want to grow your money without risking everything you have. Thankfully, there are things you can do to increase your stake without incurring too much risk. Here are a few things you can do to mitigate risk.

1. Keep yourself updated with industry trends

Successful investors make good bets because they know what they’re investing in. You don’t need to go to business school to learn the secrets, however. Even something as simple as watching the news and subscribing to trade journals can go a long way in securing your investments.

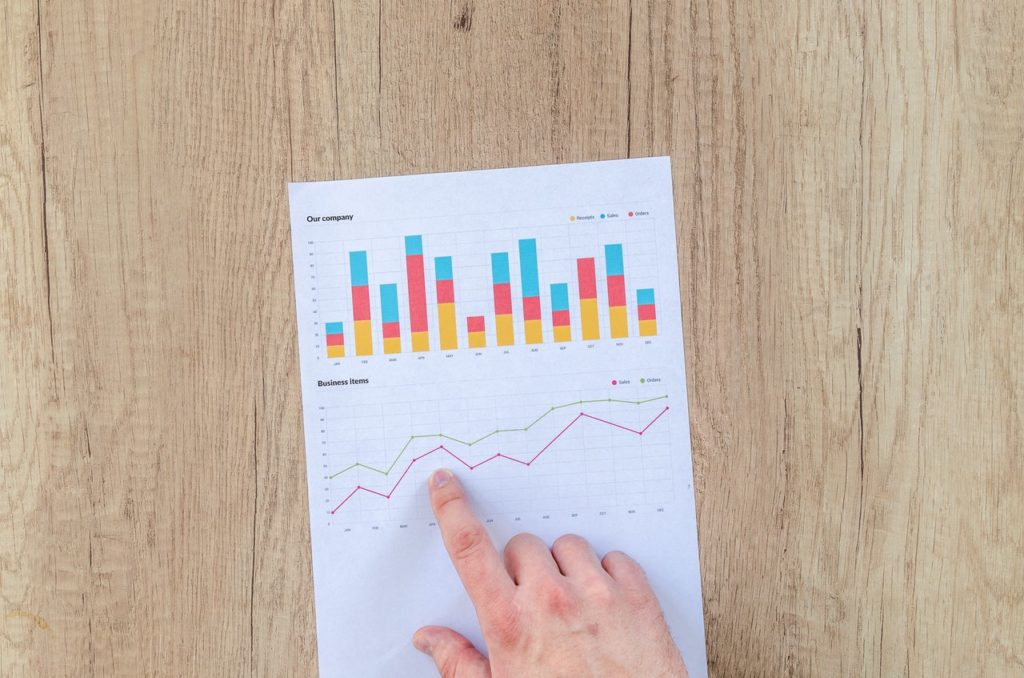

Stockbrokers and high-value investors rely on up-to-date information to make informed decisions. While subscribing to a Bloomberg terminal might be overkill for a casual investor, you still need to ensure that you know what’s happening in the economy. Most financial information is publicly available, and if you read enough newspapers and journals, you can start piecing together these disparate pieces of data to recognize economic trends.

Some people consume every piece of data they get their hands on, while others are more laid-back in their portfolio. Aim for somewhere in the middle. You don’t want to overly concern yourself with the minutiae of stock movements, but you also want to stay informed.

As a general rule, check your portfolio once a month and rebalance as needed. Don’t be scared if stock prices suddenly drop. Market fluctuations are perfectly normal, and as long as the fundamentals are sound, you should have nothing to worry about

2. Always diversify

If there’s one thing you need to remember, it’s to diversify your holdings. Diversification basically means spreading your investments across different things. Instead of putting $1000 in one company, you invest $250 in four different companies. That way, your investments remain intact even if one company tanks.

There’s no shortage of options when it comes to investments. You can buy government bonds or real estate or invest in public companies through the stock exchange. Diversifying your portfolio is a proven way to grow your assets while insulating you from the economy’s ups and downs.

3. Do your research

Unfortunately, casual investors are more likely to fall for investment scams. Many of these cases often go unreported because the victims are unwilling to admit that they were duped. If you’re not familiar with the markets’ inner workings, it can be difficult to discern a scam from a legitimate investment. After all, we’ve all read reports of legal businesses that were later unmasked as fraudulent.

It’s your duty to do your research before investing in anything, even if the advice comes from your broker or banker. In any countries, like Singapore, you wouldn’t get a business loan without comparing figures, and the same is true for your portfolio. At the very least, the company should pass all government checks. If it looks or feels dubious, it probably is.

However, navigating the world of finance can be very difficult, even to seasoned investors. You have to deal with different organizations, each one with a different focus area. For instance, stocks and international currencies are regulated by two different bodies. It also doesn’t help that the laws can be difficult to understand. Read up whenever you can and ask for help if you need it.

The bottom line

These three tips will help you make better investment decisions. Investing may seem overwhelming, and the learning curve can be quite steep initially, but with patience and perseverance, you’ll become a smarter investor in no time. Finally, don’t be afraid to defer to another person’s expertise, especially if their knowledge can help you grow your wealth.